Gold or silver coins - apologise, but

Are: Gold or silver coins

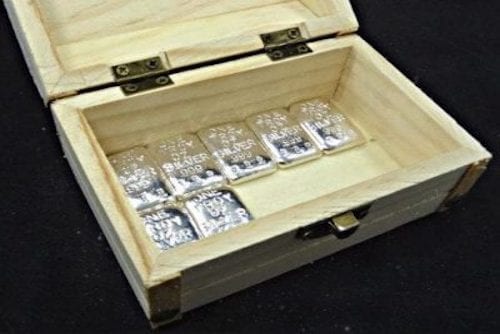

| Pawn stars chumlee coin | 1976 silver dollar coin |

| Gold or silver coins | 464 |

| Rulers of britain coin collection | 385 |

Should You Invest in Silver Bullion?

What are the pros and cons of investing in silver bullion? Read on to learn why now may be the time for investors to enter the market.

As with anything in the market, investing in silver bullion has both pros and cons, and what’s appealing to one investor may not be a good choice for another.

Whenever the silver price rises, investors’ interest in the silver market grows, with many wondering if it is the right time to buy physical silver and make it part of their investment portfolio.

While silver can be volatile, the precious metal is also seen as a safety net, similar to its sister metal gold — as safe haven assets, they can protect investors in times of uncertainty. With tensions running high, they could be a good choice for those looking to preserve their wealth in these difficult times.

With those factors in mind, let’s look at the pros and cons of buying physical bullion in the form of silver.

EXCLUSIVE! Who's Manipulating Silver And Why?

Our FREE Report Will Answer All Your Questions and UNCOVER The Truth.

Everything You Need To Be A More Informed Investor!

Pros of investing in silver bullion

1. Silver can offer protection — As mentioned, investors often flock to precious metals during times of turmoil. When political and economic uncertainty are rife, legal tender generally takes a backseat to assets like gold and silver. While both gold and silver bullion can be appealing to investors, the white metal tends to get overlooked in favor of individuals investing in gold, even though it plays the same role.

2. It’s tangible money — While cash, mining stocks, bonds and other financial products are accepted forms of wealth, they are essentially still digital promissory notes. For that reason, they are all vulnerable to depreciation due to actions like printing money. Silver bullion, on the other hand, is a finite tangible asset. That means although it is vulnerable to market fluctuations like other commodities, physical silver isn’t likely to completely crash because of its inherent and real value. Market participants can buy bullion in different forms, such as a silver coin or silver jewelry, or they can buy silver bullion bars.

Chris Duane, an investor and YouTube figure, has said he puts his metal where his mouth is by liquidating his assets and putting the money into silver bullion when prices get low. He believes that our money system, and indeed our entire way of life, is built on unsustainable debt, and the purpose of investing in silver bullion and the silver market is to take yourself out of the mathematically inevitable collapse of that system.

3. It’s cheaper than gold — Between gold bullion and silver bullion, the white metal is not only less expensive and therefore more accessible to buy, but it’s also more versatile to spend. That means if you are looking to buy silver in the form of a coin to use as currency, it will be easier to break than a gold coin because it is lower in value. Just as a US$100 bill can be a challenge to break at the store, divvying up an ounce of gold bullion can be a challenge. As a result, silver bullion is more practical and versatile than physical gold, making this type of silver investment more appealing.

4. Silver offers higher returns than gold — Because the white metal is worth around 1/79th the price of gold, buying silver bullion is affordable and stands to see a much bigger percentage gain if the silver price goes up. In fact, in the past, silver has outperformed the gold price in bull markets, according to GoldSilver. GoldSilver claims that, from 2008 to 2011, silver gained 448 percent, while the gold price gained just 166 percent in that same period. It’s possible for an investor to hedge their bets with silver bullion in their investment portfolio.

5. History is on silver’s side — Silver and gold have been used as legal tender for hundreds and thousands of years, and that lineage lends the metal a sense of stability. Many find comfort in knowing that this precious metal has been recognized for its value throughout a great deal of mankind’s history, and so there’s an expectation that it will endure while a fiat currency may fall to the wayside. When individuals invest in physical silver, whether that be through buying a silver bar, pure silver, a coin or other means, there is a reassurance that its value has and will continue to persist.

6. Silver offers anonymity — Whether you value your privacy or not, silver has the same benefit as cash in that it gives users a degree of anonymity with regards to spending. Not everyone wants all of their transactions to be part of the public record, and privacy is a necessary component of democracy, as per Glenn Greenwald’s TED Talk. That is another benefit for investors who want to buy silver bullion.

BRAND NEW! Take Advantage Of Silver On The Rise Before It's Too Late

PROMISING Stock Picks! EXCLUSIVE Interviews! JUST RELEASED Trends!

Everything You Need To Watch The Dollars Come Pouring In!

Cons of investing in silver bullion

1. Lack of liquidity — There is a chance that if you hold physical silver, it may not be immediately liquid. In order to make common purchases such as groceries, you are not able to use silver bullion bars or a silver bullion coin, so you will need to convert that to currency first, and the ability to sell in a hurry can be an issue. In a jam, pawn shops and jewelers are an option, but not necessarily the best-paying one.

2. Danger of theft — Unlike most other investments, such as stocks, holding silver bullion can leave investors vulnerable to theft. Securing your assets from looting by using a safety deposit box in a bank or a safe box in your home will incur additional costs. Additionally, the more physical assets, including silver jewelry, that reside within your home, the more at risk you are for burglary.

3. Weak return on investment — Although silver bullion may be a good safe haven asset, it may not perform as well as other investments — for example, real estate, or even other metals.

Mining stocks may also be a better option than silver bullion for some investors. As Randy Smallwood, president and CEO of streaming company Wheaton Precious Metals (TSX:WPM,NYSE:WPM), has said, “Streaming companies will always outperform bullion by itself.” He attributes this to organic growth and dividend payouts that bullion doesn’t provide. Other options for investors interested in silver include investing in an exchange-traded fund or silver futures.

4. High silver demand leads to higher premiums — When investors try to buy any bullion product, such as an American silver coin known as a silver eagle, they will quickly find out that the physical silver price is generally higher than the silver spot price due to premiums put in place by sellers. What’s more, if demand is high, premiums can go up fast, making the purchase of physical silver bullion more expensive and a less attractive investment.

This is an updated version of an article originally published by the Investing News Network in 2016.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Fear And Debt Push Gold To New Heights In 2020. What's Coming In 2021?

All The Answers You NEED In Our Precious Metals Outlook Report!

Grab Your FREE Report Today!

When Will Silver Go Up?

Many investors are asking themselves, “When will silver go up?” Unfortunately it's tough to get a...

5 Silver ETFs at a Glance

ETFs are becoming increasingly popular with investors. If you're interested in silver ETFs, here are five...

8 responses to “Should You Invest in Silver Bullion?”

Hi PB

What’s the detail of your broker please

Its a question of “when”, not “if”. The global financial system is based on ever increasing amounts of debt. Each new $ of debt adds less and less in economic growth and sucks in more $s to finance it. The endgame outcome is certain, the path is uncertain. Stocks can surely outperform PMs in the interim but tough to imagine the +10yrs of expansion we have already seen is sustainable. Stocks and real estate looks very expensive relative to PMs. I am super leveraged on real estate where I earn a good rental yield but have also been accumulating silver and gold in lieu of keeping cash in the bank. You cannot compare investing in PMs with investing in stocks or real estate, its apples and pears. I would rather invest in silver than keep excess money in the bank. Luckily my silver bullion is highly liquid, I pay 3% over spot for 1kg bars and as long as I store it with my broker (who charges 0.6% annual), I get 2% back on any sales if I need quick fiat ccy. So final net cost is 1% plus storage costs. Im happy to keep my silver with my broker for the next few years until I have a better handle on the global outlook. Long term plan is to take delivery to avoid paying longterm storage costs and have my children inherit the bulk of my PMs. In fact, I dont have any savings accounts for them. I allocate a portion of my PMs to them each month as if I would be saving fiat ccy for them.

I suspect the value of my PMs during the next economic downturn will be enough to cover most or all of my housing loans. Then I will increase my cashflow and look forward to retirement.

I stack gold and silver an insurance policy for my grandchildren. I love them!! I am certain that our monetary system will collapse when?? Don’t know but just look at the way our leaders are governing.

Oh wow, you are so far off in left field. People like me buy silver for when the dollar collapses. We want the price to keep going down to lower the dollar cost average.

Oh and buying a safe was no problem at all. I need to buy another one in addition 🙂

A safe deposit box at the bank? Really? Countless people have made articles on this. The answer is absolutely not with a bank!

The only advantage of turning your paper money into silver is one can not catch on fire and be lost BUT don’t ever expect to make ANY money investing in silver since it only goes up pennies per ounce and loss dollars per ounce.

Coins are even worse than bars since you pay extra for the “Uncirculated brilliant” and that means you better not ever touch them with your hands and when you get them they better ALL be as perfect as possible and buying the ones that are given even higher ratings cost insane amounts and the only one making a profit would be you great-grandkids when they are old.Just look at the last 10 years of the value of bars and coins and you see that if there is any rise in value it is the rise of the sellers price and not that you could sell your silver for a profit.

As far as storage……well if you buy it you should not live in a place where you have to buy a safe or insurance unless you want to lose even more money and you will never have so much silver or gold that you can’t figure out a place to stash it in your house (no not next to the wood stove or fireplace)

BUT if you want to buy my 100 oz bar or 100 oz’s of uncirculated coins then you can buy all of it for $5000 with free shipping.

Is silver and gold a good investment well don’t listen to anybody you decide, first of all in case you did not know, stay away from t/v adds that are trying to sell you gold coins, the U/S mint has said sales in U/S Gold Eagle coins fell by 67% between February 16th 2016) and February 17th 2017) sales of physical Gold and Silver Are

collapsing across the entire industry, The world council data also

shows a large decline in physical precious metals market in 2016

especially with bars-coins-jewelry the new figures show that U/S Gold Eagles and Silver coins are down 75% although paper gold is

rising, physical is falling. so is Gold and Silver a good investment, well I definitely know better investments.

0 thoughts on “Gold or silver coins”